In 2015, even the CEOs of rival estate agencies were encouraging their franchisees to take a punt on shares in Purplebricks.

Hybrid estate agency was by no means a new idea, with companies including Emoov, Tepilo and EweMove occupying the UK hybrid and online estate agency scene since 2009.

But the PR-heavy movement behind Purplebricks' model had been warmly welcomed by home sellers around the UK—pay a flat fee to list on Purplebricks, and never pay a commission to an agent again.

Built on the idea of saving vendors significant sums of money on agency fees when selling their homes, Purplebricks launched to much fanfare in 2014 as a saviour to the disenfranchised masses who were sick of handing over thousands of pounds to unlikeable, untrustable high street estate agents.

It was a model the industry was paying very close attention to, and Purplebricks knew it.

International expansions followed, with a high-profile presence in some of the biggest markets in the world. Purplebricks looked set to be one of the biggest real estate disruptors of all time.

But... that's not what happened. What promised to be a new dawn for UK real estate agents slowly began to spiral out of control.

Purplebricks faced the wrath of the BBC, unceremonious outings by Wired and Forbes, fled multiple international markets, and even fired its founder and CEO.

Within two years of international expansions, Purplebricks found itself back in its native UK, dealing with a global pandemic and catastrophic losses far in excess of the company's forecasts.

After withholding financial results, losing its second CEO and multiple rounds of layoffs, Purplebricks threw in the towel in February 2023 and was sold for just £1 in June.

It's a wild ride, for sure. Here's the story of the rise and fall of Purplebricks.

A fresh, disruptive model is born. Purplebricks is conceived by Michael and Kenny Bruce, a brotherly team with plenty of industry experience. The business is founded on key pillars including transparency, customer service, unique tech, and aggressive pricing.

In an interview with Medium, Michael Bruce says:

"By April 2012 we had spoken to thousands of people: sellers, buyers, landlords, tenants. Based on these conversations we started Purplebricks wanting to offer convenient, transparent service, without the poor high street reputation.

People tend to interact with property when estate agency offices are shut. 51% of our traffic comes outside of normal agency hours."

In April, Purplebricks launches publicly and starts listing homes in the UK. Purplebricks is a credible alternative to the high street agents and doesn't charge a commission for completed sales.

The firm employs "Local Property Experts" (LPEs), trusted agents who work flexibly within a pre-defined catchment area, winning listings on behalf of Purplebricks.

Vendors can get a free valuation of their property, receive a valuation report, and can instruct Purplebricks to list their property for a flat fee (£599).

Specifically, Purplebricks advertises properties on Rightmove as a standard part of the deal, with vendors paying an extra fee for a Premium Listing or Featured Property if they want.

Purplebricks also takes photos of your property, creates your ad, manages viewings and offers additional bolt-ons for an extra fee.

Vendors can pay up-front, in ten months' time, or when their property sells, whichever comes first.

In August, the company raises £8M in outside investment from British fund manager Neil Woodford taking a 30% stake in the company at a valuation of in excess of £20M.

Woodford is a former star fund manager at Invesco Perpetual, one of the largest investment managers in the UK handling assets worth in excess of £90M

The first murmurs of discontent arrive when agents point out that Purplebricks is listing on Rightmove—circumventing the agents—but still achieving a similar presence on the country's biggest portal.

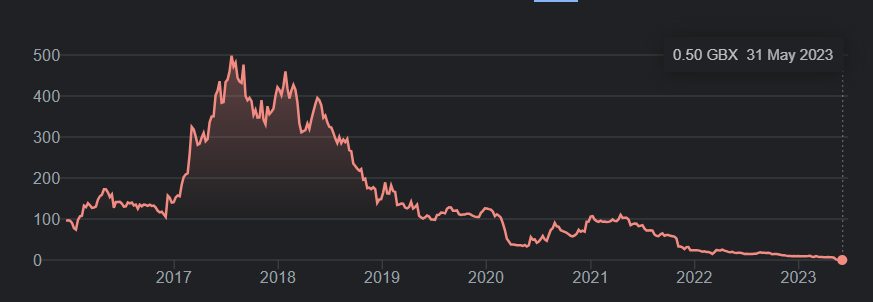

Purplebricks goes public in its first full year of operations in December—the first online agent to float on the stock exchange. Share prices start at 96p in January 2016 with the company worth an estimated £240M, ten times its valuation when Woodford invested last year.

However, the firm's freelance agents, dubbed Local Property Experts (LPEs), are criticised for not selling the properties they list. LPEs aren't financially incentivized to complete transactions, only win listings, and it's an issue that lingers for Purplebricks into the future.

Purplebricks covers the entirety of the United Kingdom by the end of 2015.

Purplebricks hits Australia in June when it hires an Australian marketing agency, funding the expansion with £10M of its own cash.

Purplebricks launches its "Commisery" tagline in December. The campaign wins awards, ushers in a whole new generation of estate-agency-sceptics, and is lauded as being one of Purplebricks' biggest successes and a major reason behind Purplebricks' rapid expansion and brand recognition:

The highlight of the year is that Purplebricks enters the US market in September after raising $60m in funding from a special stock offering. The offer is the same as in the UK: Purplebricks will list your property for $3,200—but you need to pay even if the online agent doesn't sell your home.

However, trouble brews in August when the BBC's Watchdog investigates Purplebricks for repeating misleading claims (that customers could save an average of £4,158 by using Purplebricks) that had already been banned by the advertising watchdog. Purplebricks apologizes and share prices slump 7% in one day.

The Watchdog also finds that customers who choose to defer payment are in fact forced into entering a loan agreement with an external company. Purplebricks is also criticized for its reluctance to release figures for how many properties it sells, which the company says is commercially sensitive information.

Watch the full Watchdog segment, including a live interview with CEO Michael Bruce, below:

Meanwhile, the Australian arm of Purplebricks loses £6.1M this year, with administrative and marketing costs hitting roughly £3M each.

Purplebricks shares hit an all-time high of 498.5p in January.

The company expands to Canada in July when it acquires Canadian real estate company DPCF for $38M. DPCF operates a similar flat fee model to Purplebricks and already occupies a 20% market share in Quebec, with further presence in Ontario (2% market share) and Western Canada (2.3%).

Meanwhile, Purplebricks also builds its presence in Europe when it takes a 25% stake in German agency Homeday in October. Homeday is a brokerage that also employs agents in a similar model to Local Property Experts, with a strong focus on data and technology. Axel Springer is also involved in the deal.

Purplebricks says it continues to trade in line with the guidance it issued in July. It forecasts full-year revenue of £165M-£185M. Revenue and gross profit doubled in the year to April 30, but operating losses quadrupled in July.

However, full-year losses for Australia almost doubled in 12 months, rising from £6.1M to £11.8M.

In April, an anonymous Local Property Expert (LPE) exposes all in an exclusive interview with Property Industry Eye. Bombshells include 90-hour working weeks to make ends meet and a catchment area including properties up to 57 miles away. He admits training was good, but that ultimately life as an LPE was an 'unsustainable' way of earning a living.

Pictured: Michael Bruce, co-founder and first CEO of Purplebricks

In May, Michael Bruce (pictured) is fired by chairman Paul Pindar with the company admitting it expanded too quickly.

Vic Darvey replaces Bruce as the firm's new CEO. His first job is to manage the shuttering of Purplebricks' US and Australia operations. The US expansion has contributed to spiralling £52.3 million losses—double the amount from 2018—with Australia haemorrhaging £18M in just six months. The good news is that Purplebricks reaffirms its intention to continue its Canada operation despite the Australian and US closures.

In June, Axel Springer increases its stake in Purplebricks to 26.6% (from 12.4%), injecting approximately €49M into the company. At the same time, Fund Manager Neil Woodford decreases his stake in the company.

In August, Purplebricks moves on from "commisery". Darvey wants to focus on the firm's core offering and LPE's instead of bashing agent commissions, which he believes has run its course as a marketing message.

It's been a tough year for Purplebricks, but it gets worse in September when Wired UK publishes an investigation that finds that Purplebricks has been 'selectively screening reviews' to skew its online ratings to be more positive. It emerges that Purplebricks users have been strongly recommended to leave 5-star reviews before their property has been sold.

The year starts in controversial fashion in January when Forbes magazine reports that Purplebricks Canada employees have been bribed with paid days off by getting their friends and families to give Purplebricks 5-star reviews on Facebook and Google—even if they haven't used the service.

As the pandemic emerges and takes hold, Purplebricks switches its model from hybrid to totally online. The company says it has £35 million of cash on its balance sheet—and no debt.

Helena Marston joins as Chief People Officer in May. She will be CEO within 24 months.

Purplebricks pulls out of Canada in July when it sells its Canadian assets to Desjardins Group for $60.5M. Desjardins made the move to buy, not Purplebricks looking to sell. CEO Vic Darvey says the sale allows Purplebricks to focus on its UK operation.

Former CEO Michael Bruce announces his next venture in July, a proptech startup that soon gets a name - Boomin.

Purplebricks goes through multiple rounds of layoffs as it focuses on the core UK market.

In November, Purplebricks shares fall 37% when it reveals profits will be "below previous guidance"—from a forecasted profit of £1.2M to a significant loss of £12.4 million. Purplebricks also updates its 2022 guidance from a forecasted profit of £7.9M to a loss of £7.1M—a £15M negative swing.

In December, Purplebricks delays releasing its financial results and warns shareholders that the firm may be forced to pay up to £9M in compensation to tenants of landlords due to deposit infractions.

In March, Vic Darvey steps down as CEO. Helena Marston replaces him in April. Meanwhile, Steve Long leaves his role as CFO in October after just nine months in the role. He is replaced by Dominique Highfield.

In November, Lecram Holdings Ltd—a 5.19% stakeholder in Purplebricks—calls for the head of chairman Paul Pindar after multiple rounds of redundancies and record low share prices.

In December, Purplebricks lays off 10% of its workforce—approximately 100 staff lose their jobs.

Meanwhile, Boomin (Michael Bruce's new venture) goes bust.

Purplebricks reluctantly puts itself up for sale in February after announcing it expects to lose between £15m-£20m this year, more than double the previously anticipated loss of between £8.8m-£11.3m.

Lecram Holdings repeats its call for Paul Pindar to step down from his role.

In March, Axel Springer removes its representative from the boardroom amid talks of a sale.

In May, Purplebricks agrees to a deal for the company to be sold to rival online estate agent Strike for £1. Shareholder Lecram Holdings Ltd also submits an offer, for 0.5p per share, but withdraws the offer when it becomes apparent that Strike's offer is the preferred option.

Also in May, Contractors4Justice (C4J) steps up attempts to get Purplebricks to fork over up to £9M to pay its LPEs for unpaid holiday pay, pension contributions and car allowances, potentially holding up the Strike deal. However, Purplebricks quickly brushes off the claim as a publicity stunt and says it has already won a legal case against C4J.

Purplebricks is sold to Strike in June after 91% of shareholders backed the offer.

Purplebricks lives to fight another day, with chairman Paul Pindar's statement that he was “disappointed with the financial value outcome” an understandable one.

The firm will use £5.5m in cash to pay expenses and costs not covered by Strike, with shareholders Axel Springer (26.5%), JNE Partners (11%), Momentum Global Investment Management (7%), Hargreaves Lansdown Asset Management (5%) and Pindar himself (5%) each sharing £2m from the sale.

In Sam Mitchell, the disruptor agency has a new CEO who has quickly gotten to work, introducing a new look pricing strategy that cut listing fees by 26% on day one—and an enticing 67% listing fee reduction for properties in London.

It's a daring offer with a retro-Purplebricks vibe to it. It is certainly disruptive and will, the firm hopes, prove enticing to hopeful vendors.

But make no mistake, Purplebricks' new strategy is one born out of necessity: the firm needs a quick recovery with aggressive pricing to whip up some positive PR after some difficult years.