Opendoor has revealed that it generated 55% less revenue in 2023 than in the previous year. The San Francisco-based iBuyer sold fewer homes but reduced net losses from $1.4 billion to $275 million for 2023.

Despite purchasing 68% fewer homes in 2023 compared to 2022, Opendoor CEO Carrie Wheeler insisted that the company had put itself in a good position to grow in 2024.

“The past year was about focus, execution, and progress. Our fourth quarter results exceeded the high end of our prior guidance ranges, demonstrating our ability to deliver, despite ongoing uncertainty in the housing market. We increased our home acquisitions sequentially throughout the year, built a new book of inventory that is performing well, and drove structural efficiencies across our platform that we expect will benefit the Company for years to come. Most importantly, we've remained steadfast in our vision of helping people move with simplicity and certainty,” said Carrie Wheeler, CEO of Opendoor.

Wheeler continued, “The progress we made in 2023, combined with the potential for a more normalized macro backdrop, positions us well to rescale our business in 2024. Opendoor stands alone as the largest digital platform for residential real estate transactions, and we will continue to invest in our products to be the catalyst for change in how consumers sell and buy homes.”

Opendoor is one of the few remaining iBuyers in the U.S. market. The company has outlasted the likes of Zillow and Redfin and now only really faces competition for the service from Offerpad in certain regional markets.

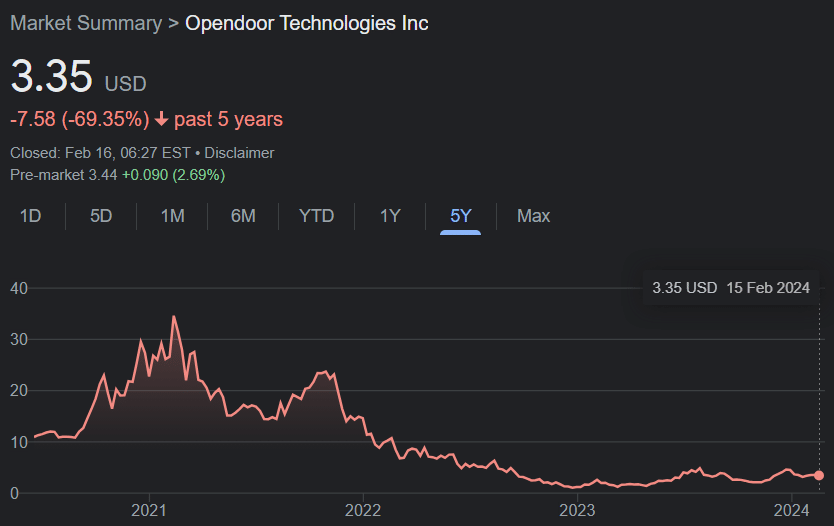

With net losses totalling over $2.5 billion in the past four years alone,2024 is a crucial year for the Opendoor which will have to prove its ability to survive as a going concern. The iBuyer model itself has come under increasing scrutiny in recent years after buoyant market conditions in 2021 gave way to stubbornly high lending rates for much of 2022 and 2023.

Below: Opendoor share price - credit Google