Malaysia property portal, iProperty.com.my, has recently unveiled its new Home Eligibility Indicator, LoanCare, to help users up their chances of getting a home loan approval and reduce the number of rejected applications.

If a bank rejects the application for someone looking for a home loan, they might end up being locked out of the market without being allowed to apply for another home loan for up to six months. IProperty.com.my wants to help potential home owners like that—those who need as much available information as possible to make better decisions—decide how to move forward from there.

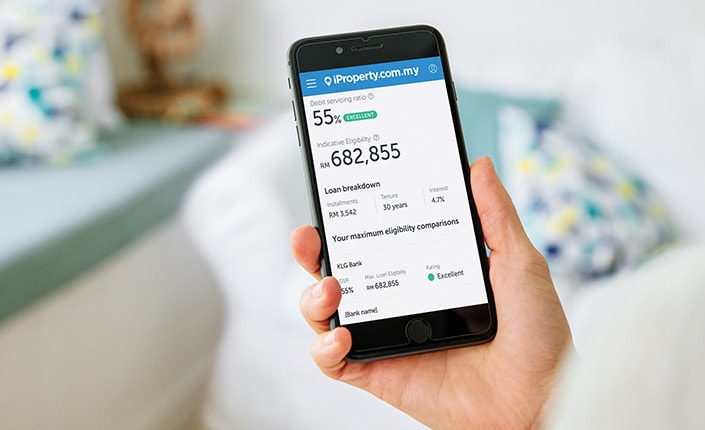

With LoanCare, users are provided with information about their indicative loan eligibility and explanations on what they need to find the best loan for their needs. The tool is free and simple to use. It compares and calculates a user's eligibility with up to 10 different banks, giving Malaysians an increase probability of home loan approval.

With LoanCare, users are provided with information about their indicative loan eligibility and explanations on what they need to find the best loan for their needs. The tool is free and simple to use. It compares and calculates a user's eligibility with up to 10 different banks, giving Malaysians an increase probability of home loan approval.

In Malaysia, there are a number of different Debt Servicing Ratios (DSR)—percentage of the valuation of how much a person's income is used to service debt installments. Most Malaysians are unaware of these ratios and therefore, do not know to utilize them. With LoanCare, buyers can access this information for free without needing to visit a bank.

LoanCare sets itself apart from other loan tools because it does not require a user to release their Identification Card numbers, leaving the process a little more secure for potential buyers.

According to David Mawer, iProperty.com.my General Managerstated, the goal is to help Malaysians increase their changes of getting an approval on a home loan, which corresponds with the country's current government initiatives to boost home ownership and focus on the affordability of property within the market.

“Insights such as a maximum eligibility comparison with banks and individual DSRs should not be difficult to find. Everyone deserves easy access to any and all information that will help them get the right home loan, without risking rejection,” he said.

“We are focused on helping people make better and more informed property decisions while bringing transparency to the home loan process. LoanCare, iProperty’s Home Loan Eligibility Indicator,is a free and simple way for Malaysians to increase their chances of getting a home loan,” he added.

SOURCE iProperty.com.my

Edited by V. Haviland

Join us in Miami Beach, June 5-7 for the Global Online Marketplaces Summit.

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields