After having been denied a merger with the Prosus-owned horizontal player Avito last month, Russian property portal Cian floated on the NYSE last Friday.

The float brought $290 million which the firm will use to pay off part of an outstanding loan and, according to CEO & founder Maxim Melnikov, may also go towards future M&A activity.

Headlines in the industry from the world of Russian real estate marketing tend to be few and far between, so we thought we'd take the opportunity to read Cian's prospectus and look under the bonnet of a market-leading real estate vertical business to see how it compares to its national competitors and its international peers.

Founded in Moscow in 2001 but based out of Cyprus, Cian claims to be in the top ten most trafficked online real estate classifieds sites in the world. Operating in a market worth an estimated $238 billion and with an immediately addressable market of $6 billion, the portal company has big plans "to continue growing our business and achieve profitability margins enjoyed by our best-in-class international peers".

Cian generates revenue from listings services and, like a lot of leading portals, is also putting considerable resources into trying to get itself directly involved in real estate transactions. The firm reports results of the following segments:

Like many portals around the world, the Russian market leader is currently changing its main revenue-generating advertising product. Cian is moving from a simple pay-to-list model to a subscription-based model which includes access to its value-added services. In the first half of 2021, 41% of listings were on a subscription basis compared with 26% in the second half of 2020.

Within Russia, Cian is the undisputed market leader when it comes to specialist real estate websites, especially in the more profitable urban areas around Moscow and St Petersburg where the portal claims 56% and 49% 'top of mind share' respectively.

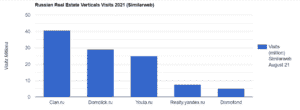

In terms of specialist competition, Cian is up against DomClick (owned by Sberbank), Yandex.Nedvizhimost (owned by search giant Yandex) and Domofond (owned by Prosus).

Credit: Similarweb Data

When it comes to traffic, Cian is way out ahead of its vertical competitors although wary of the power that Yandex could exert on the market. The real threat however is from the generalist classifieds site Avito which is strong in the provinces and which Cian admits has historically had "a large audience and high brand awareness".

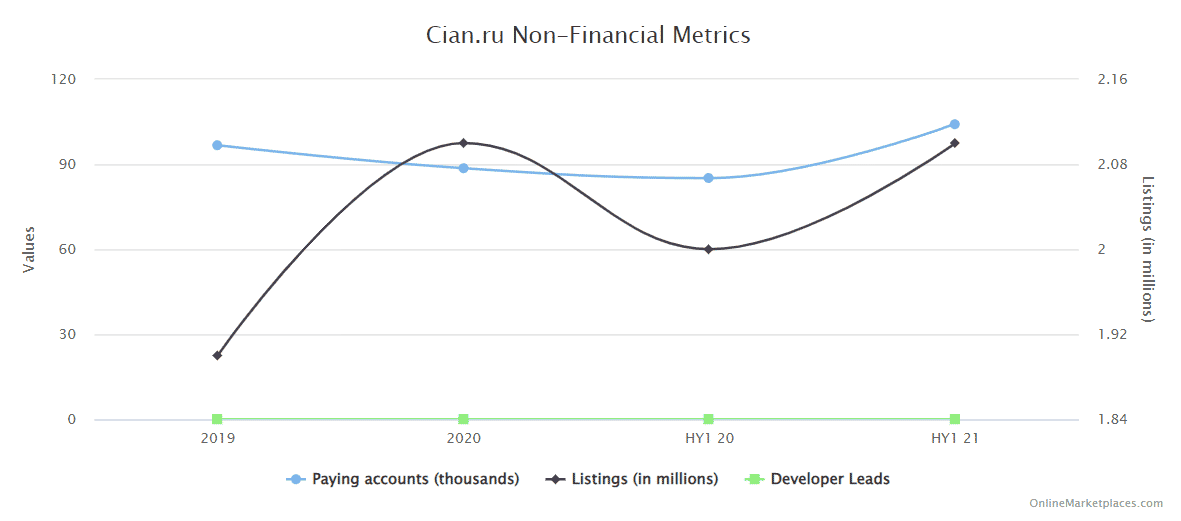

Listing, customer and lead numbers have all been moving in the right direction since the pandemic affected the first half of 2021. The company's prospectus cites an external report which claims around 80% of Russian residential real estate agents are listed on Cian, so coverage is not an issue.

Just as global portal companies are witnessing, Cian's audience is expanding much faster than its listings volumes, and it's an audience that is increasingly coming via mobile. The share of the portal's mobile audience was 76.2% in the first half of 2021, up from approximately 72.8% in the second half of 2020 while leads from mobile represented 66% of the total, up from 64.3%.

Cian is predicting an average annual CAGR of 27% between now and 2025. As for the here and now, the company stopped monetisation of listings in April 2020 in response to the pandemic. Monetisation had restarted again in Moscow and certain urban regions by July 2020, and in certain other regions in the first half of 2021, but potential investors might be concerned that "monetisation in many other regions remains temporarily suspended".

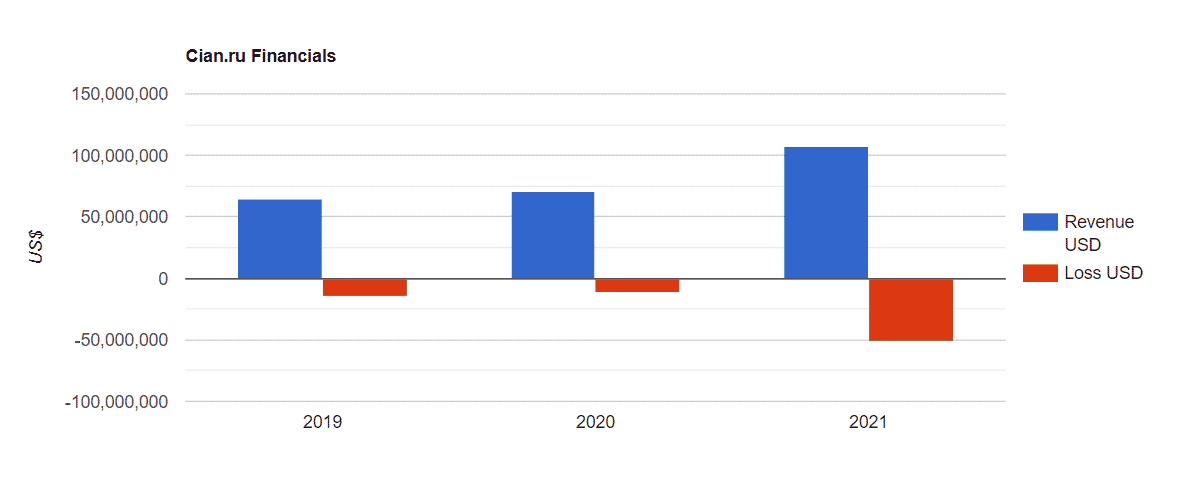

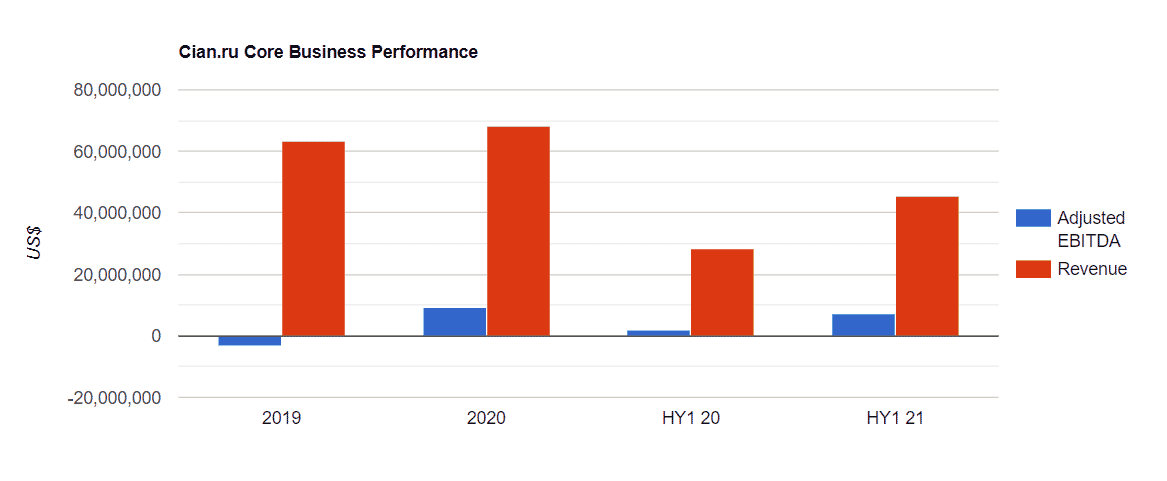

Despite that, the company is on track for record revenues during 2021, although there was a notable drop in profitability over the first half of the year which was chalked up in the prospectus to "an increase in our share-based payment expense... as a result of the recognition of a portion of our long-term incentive program awards linked to the planned offering".

There is a big gap in profitability between the Moscow region and the rest of the country. While the Adjusted EBITDA for the core business in Moscow and the Moscow region was $14.9 million for the first half of 2021, core operations in the rest of the country saw negative Adjusted EBITDA of -$9.2 million.

It's a similar story when it comes to the profitability of the different business segments. While the core advertising business generated $5.7 million in Adjusted EBITDA in the first half of 2021, the mortgage business (-$3.25 million), the analytics business (-$0.5 million ), the C2C rental business (-$0.9 million) and the end-to-end offerings business (-$0.9 million) were all unprofitable over the period.

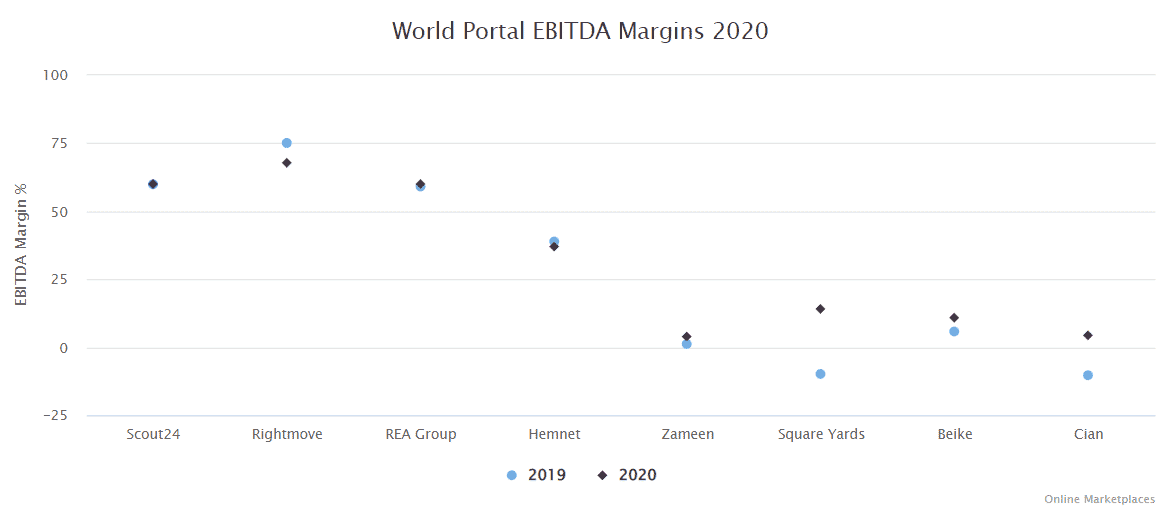

Although Cian's bottom line is still not in the black, the company doesn't have to look far for examples of classifieds companies that are profitable.

The regionally strong N1 Group, which was acquired by Cian in December 2020, was profitable in 2020 generating $0.7 million for the year and Yandex's classifieds division, which includes a real estate portal and several other classifieds businesses, recently posted Adjusted EBITDA margins of 32% for Q3.

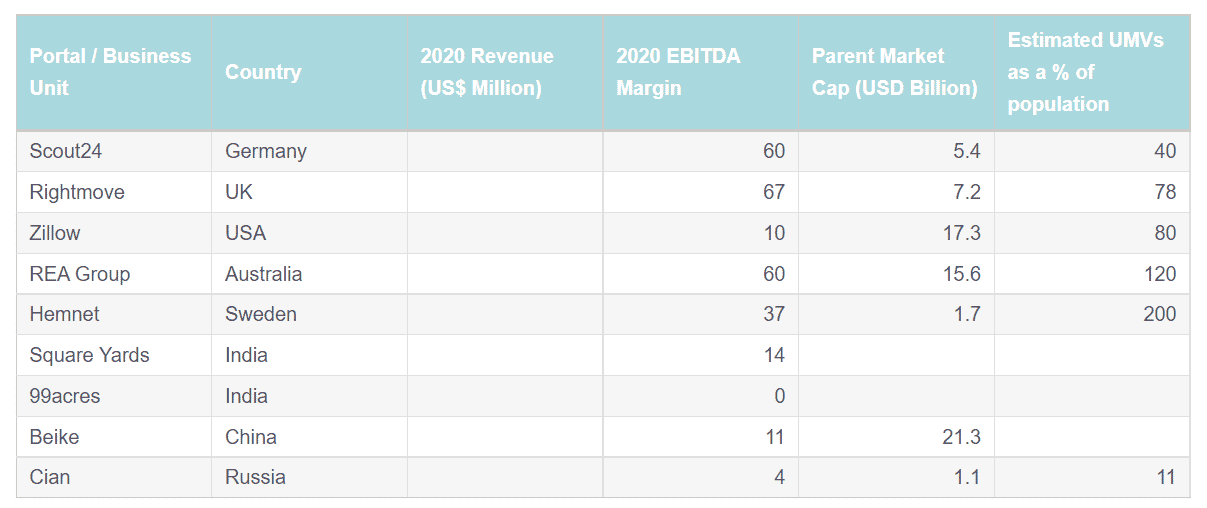

Cian's balance sheet and margins are not among the big hitters just yet. The closest comparison we found was with Indian firm Square Yards which is a fast-growing and very diverse company with an increased focus on services adjacent to the property transaction.

The big question for property portal companies however is not necessarily around their balance sheet but around the strength of their brand.

Using the traffic claimed by various established market leading portal companies in 2020 we can build a rudimentary metric that takes unique monthly visitors (UMVs) and divides the figure by the country's population. What we can see is that Cian's audience penetration is still a long way behind the likes of Rightmove, Realestate.com.au and the extraordinarily popular Hemnet.

UMVs as a % of the population was calculated from traffic figures claimed in the companies' 2020 reports. In the case of figures being given as 'sessions' or 'visits' we assumed a 1:3 ratio of sessions per user according to a recent Little data study.

Cian's is not a case of investors having to have patience while a 'first mover' that has cornered a developing market waits for macro-economic forces to transform the country's real estate industry and fill the agents' commission pool. Although the Russian real estate market is not as developed as some of its Western European counterparts there is a fairly sizeable agent commission pool out there already (estimated at $4.5 billion by Frost & Sullivan).

Cian is also taking the plunge and diving into the transaction with some innovative products which are clearly still in the development/ramping up phase.

The end-to-end rentals product, in particular, is something that has worked well in similar markets (think Quinto Andar and Loft) and which addresses a real issue in the Russian market - because of the stifling bureaucracy involved, many Russians choose not to register their rentals, something which is technically illegal and causes a lot of problems.

Getting its feet wet with transactional products is a calculated gamble that the company is taking along the lines of many market leaders who have started to see a ceiling for their listings revenue. Cian is diving into the unknown here as there aren't too many other similar products out there in Russia, and whilst the exact size of the opportunity is tough to gauge, money from an IPO might be just what is needed to scale these products and put Cian in the property portal big league.

Disclaimer: Although Online Marketplaces Executive Chairman Simon Baker is a Director of Cian, he has not influenced this article in any way. At the time of writing, the author did not own any shares in Cian. This article is not offered as investment advice.