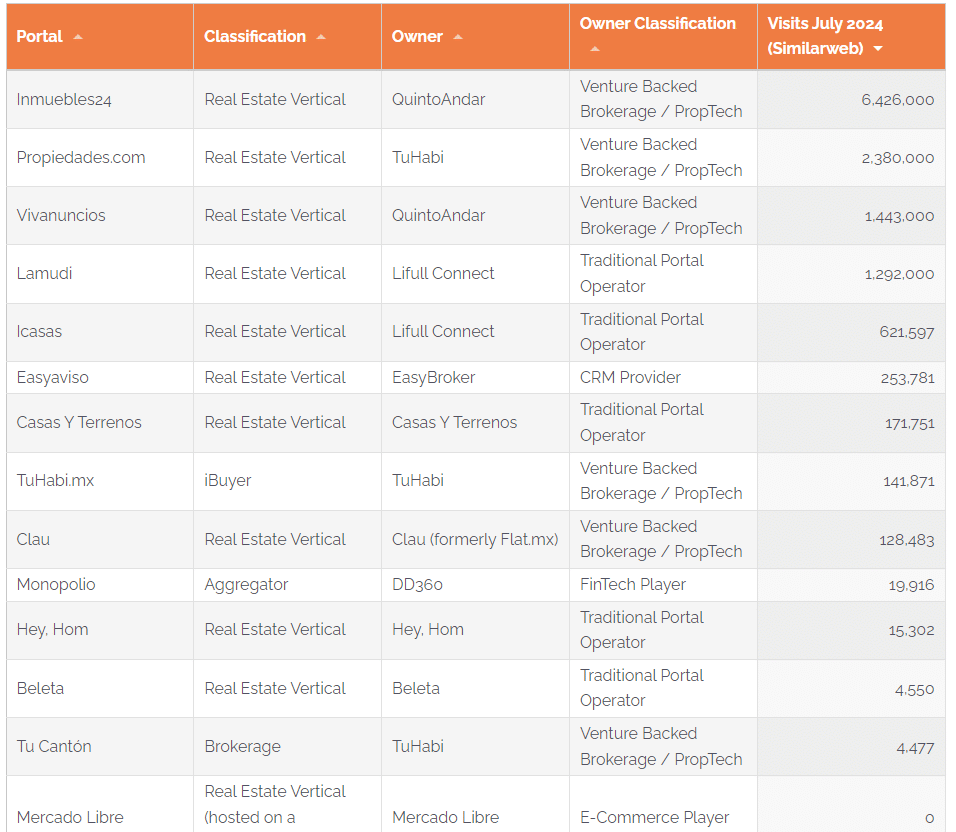

In October 2022 the Brazilian PropTech giant QuintoAndar followed up its acquisition of Navent's leading Mexican real estate portal Inmuebles24 with the purchase of number two player Vivanuncios from Adevinta—essentially creating a superpower duopoly in the country.

Then, not content with market leadership, QuintoAndar used its pricing power to force EasyBroker, one of Mexico's biggest CRM providers, to stop sending its customers' listings to the two portals. Instead, QuintoAndar offered its own CRM services free of charge for agents and brokers.

When OnlineMarketplaces covered that story in July 2023, we assumed the Mexican market was well and truly sewn up—but we keep hearing about new challenger portals in the market.

What makes these businesses think they can succeed in a country where the number one and two portals were bought up by a company worth billions?

Let's have a look...

The answer might lie in the potential that these companies see in the Mexican market.

According to one portal CEO we spoke to, there are around 400,000 residential transactions in the Mexican market each year with circa 80,000 agents chasing them.

However, these numbers are hard to pin down as the Mexican real estate industry is not formalised. The Mexican Association of Real Estate Professionals estimates only 15% of its agents are members of a recognized association and the number of transactions is based on credit issuance data. It's estimated that only around 30% of transactions make it onto that spreadsheet for one reason or another.

Then there's the data around house price appreciation (5.3% in 2023), demographic tailwinds, and an underdeveloped mortgage market.

In short, big PropTech companies and their VC backers have been enticed by what the Mexican market could be. For instance, the Colombian PropTech company TuHabi reckons that it has six times the growth potential in Mexico than it does in its home market, and QuintoAndar co-founder André Penha thinks his company can become as big in Mexico as it is in its native Brazil.

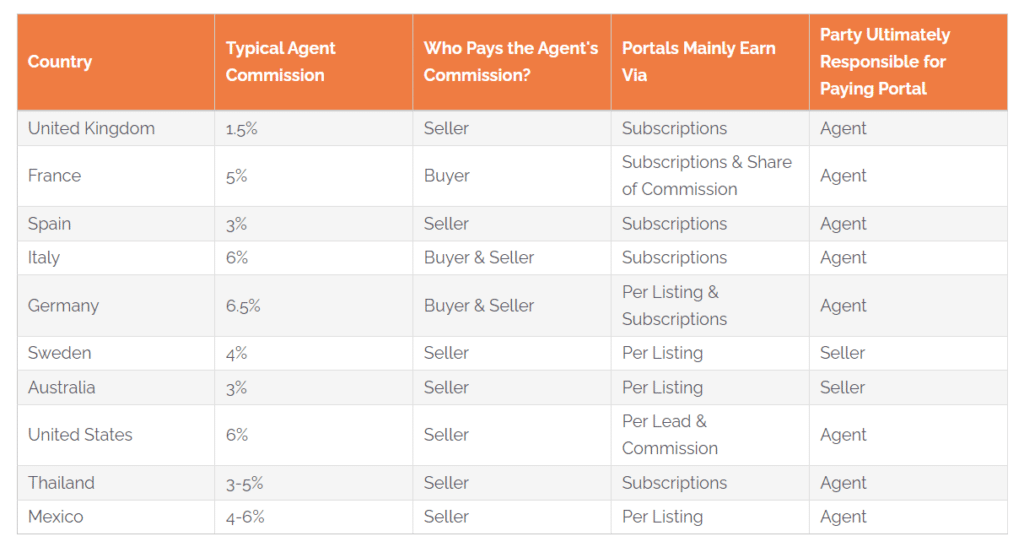

While currently, all the major portals are either free-to-list or charge per listing, there is a tempting future potential of moving to a subscription-based model and providing software services to agents.

In 2023 Dubai-based Dubizzle Group (known then as EMPG) sold Lamudi.com.mx to the Japanese operator Lifull. A year before that, the European online classifieds operator Adevinta sold off its Mexican real estate portal, Vivanuncios.com.mx to QuintoAndar.

If there is so much potential in the Mexican market, why did they pull out?

In both cases, divesting appears to have been down to circumstances rather than anything that each company didn't like about the Mexican market. Adevinta sold its shareholdings in 12 different countries between 2020 and 2023 before being taken private while Dubizzle co-founder Imran Ali Khan told us in a recent podcast episode that his company simply needed to focus on its core region.

"I remember having a discussion on Mexico and the very next call would be on the Philippines and the next one on Indonesia and it was torturous mentally to offload all of that information and then upload the new information."

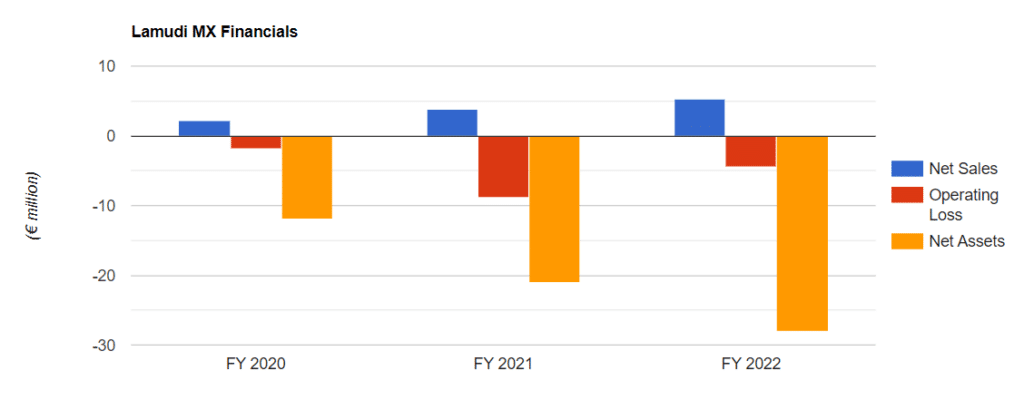

Apart from the need for Adevinta and Dubizzle Group to focus their operations, there was also the issue of cash burn; accounts made public during Lifull's takeover of Lamudi give us a pretty clear indication that running a challenger portal in the Mexican market poses a profitability challenge.

In May 2021 Lamudi was given a $60 million investment from Dubizzle Group and told the press that it aimed to climb the ladder from the number three spot (behind Inmuebles24 and Vivanuncios) to number one in three years.

It invested in glossy marketing and began to shift its business model closer to the transaction by targeting the new-build segment using the playbook that Dubizzle Group used so successfully in Pakistan with Zameen.

But by October 2022—18 months later—the two portals ahead of Lamudi had been bought out by QuintoAndar, and Dubizzle Group was looking for a way out and laying off a lot of Lamudi employees.

At the same time, competitors were springing up. Innovative aggregator Monopolio and luxury specialist Beleta appeared in 2021, followed by 'hey, hom!' in 2022.

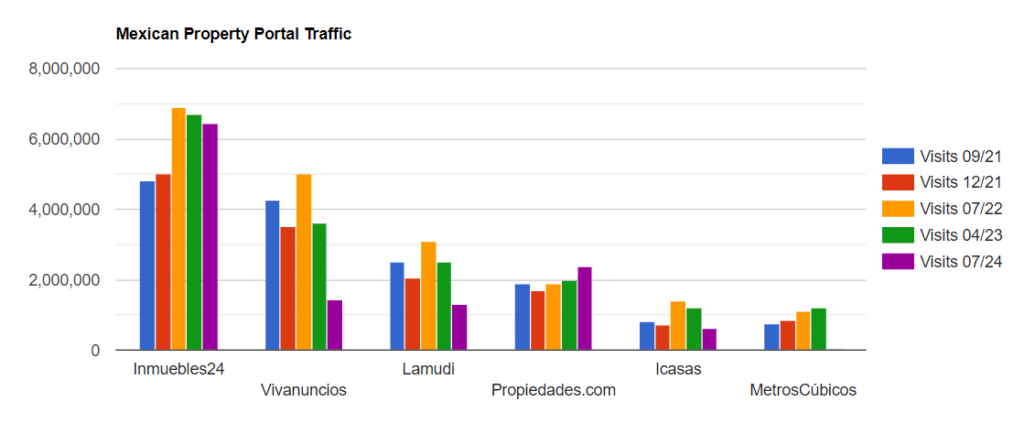

There was also the interesting acquisition of Propiedades.com. Until 2022, the portal was an also-ran and de-facto fourth-place real estate portal in Mexico. Since being acquired by Colombian PropTech operator TuHabi however, Propiedades has had fresh impetus and started to pick up traffic.

Earlier this summer the former iBuyer Flat.mx announced that it was changing its name to Clau.com following a pivot out of the brokerage and iBuying business and into the business of being a traditional real estate marketplace.

Through its subsidiary Navent, the Brazilian PropTech company QuintoAndar runs Inmuebles24 which can be reasonably considered the market-leading real estate portal in Mexico:

QuintoAndar also owns Vivanuncios, a platform that has historically been stronger in smaller cities. Under former owner Adevinta, Vivanuncios was the clear number two in terms of traffic in the Mexican market, but that no longer appears to be the case; a combination of Navent focussing on the Inmuebles24 brand and some investment from its direct rival has seen Vivanuncios drop to number three.

More than one source we spoke to for this article confirmed to us what the chart above would appear to show: Propiedades.com is now the second biggest real estate portal domain in the Mexican market.

The portal claims to be the largest real estate platform in the country with 1.2 million active listings and 270,000 exclusive listings, but in a market rife with duplicates, the reliability of these figures is debatable.

Propiedades is owned by TuHabi which, unlike some others who have dabbled in it, is still a proud iBuyer (a company that buys properties directly to sell them for a profit). The company was founded in 2019 in Bogota by Sebastian Noguera and Bryne McNulty Rojas. In June 2021 it secured $100 million from the likes of Tiger Global and in early 2022 bought Propiedades.com and the end-to-end brokerage service Tu Canton.

Meanwhile, Lamudi's third-place position in the traffic charts may not fully do justice to its parent company's reach in the market.

Lamudi Mexico is owned and operated by Lifull Connect, the overseas division of the Japanese portal operator, Lifull which also owns the Icasas portal and the aggregator brands Mitula, Trovit and Nuroa. It has attempted to amalgamate these sites for its customers recently by launching Proppit, a self-serve platform for customers to buy traffic.

Another potentially significant portal player in the market is the recently launched Clau.com. Founded in 2019 as Flat.mx by Victor Noguera and Bernardo Cordero, the company started as an iBuyer before moving towards being a tech-enabled brokerage.

Under its new Clau.com branding, the business has shifted to focus purely on lead generation as a portal having encountered challenges trying to get into transactional revenue streams.

Bernardo Cordero said:

"We've gotten much more traditional to the advertising model where we're charging upfront on lead generation to the agents both on the buyer and the seller side. And we went that route because we did e-brokerage for a while where we were participating in the transaction. But what we still saw in Mexico was that there were a lot of transactions that we weren't getting paid commissions for.

"It's really, really hard to track actual transactions in the market today. So the ability for us to make sure that we're earning our commission on every single one of the transactions that we participate in, was still very, very complex in Mexico. So for us today, the way we've designed the business is very focused on charging upfront, charging for lead generation."

Thanks to its acquisition of the Intelimétrica business in 2023, Cordero says Clau has better data than anyone in the market. The business also includes a mortgage brokerage service and is open to building "a more complete product" to help ease buyer and seller pain points.

Another player worth keeping an eye on is EasyBroker. As one of the biggest CRM providers in the market, it has been an important intermediary between agents and portals since it was founded by CEO Eric Northam in 2007.

EasyBroker also runs a portal, EasyAviso. Although the company hasn't invested heavily into gaining market share for EasyAviso to date, its position as a profitable, bootstrapped startup means that it can follow any direction it sees potential in.

Finally, Mercado Libre. The Argentinian e-commerce giant used to operate its real estate marketplace under the Metros Cúbicos portal brand which it acquired in 2015.

For a few years, Metros Cúbicos operated as a true challenger with designs on the top spot but since September 2023 its domain has been redirected to Mercado Libre's main Mexico site with the company seemingly reluctant to invest as much in its Mexican real estate marketplace as it has been willing to do in other countries.

There are estimated to be around six million visitors per month to all Mexican real estate portals—meaning circa 5% of the country's population does any kind of online house shopping.

By comparison, the figure for the U.S. is around 100% and for Spain it's 120%. In theory, the rising tide of house hunters coming online should lift all marketplaces, not just the biggest ones.

Mexico is also more challenger-friendly than other markets when it comes to listing coverage. There aren't many exclusivity listing agreements between vendors and agents in Mexico, so getting a critical mass of listings on one site shouldn't, theoretically, be a challenge.

And there is another factor key that plays into the hands of challenger portals in Mexico—the country's highly regional property market.

Several portals have told us that having great brand penetration in Mexico City doesn't necessarily mean much in the north of the country or lucrative tourist areas, for example.

According to Cordero, that brings opportunity for challengers like Clau.com who are looking to build market share quickly.

"We definitely see a lot of differences there [between different regional markets]. That brings a very, very good opportunity because I think there's not one place where there's a clear winner going forward over the next five, ten years in the markets. So I think there's still a pretty big ocean for us to continue to go after."

As more of the population searches for homes online, the culture will change and the amount of money agents are prepared to spend marketing their properties will increase.

We may see several of these Mexican real estate portal operators grow in the short term. However, for any challenger to gain a meaningful and monetizable market share over time consolidation is likely the way to go.