The Southeast Asian real estate portal operator PropertyGuru has released its figures for Q1 of the 2023 financial year. Highlights of the company's performance for the three months ended 31st of March included:

Commenting on his company's performance in Q1, Chief Executive Officer and Managing Director, Hari V. Krishnan said:

“We are pleased with our results, as PropertyGuru performed well in the face of several transitory challenges that continue to impact our core markets. While rising interest rates and government credit intervention weighed on market activity, we remained resilient and delivered good growth by helping our customers navigate the challenges they faced and confirming the value add of our solutions in all phases of the real estate cycle.”

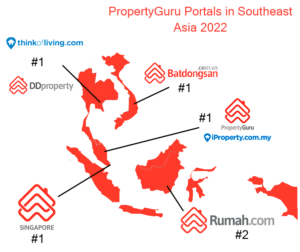

PropertyGuru operates leading real estate portals across Southeast Asia. It is the clear market leader in its native Singapore, where it claims to have more than 5x the market share of the closest competitor. The group is also the leader in Malaysia where it operates both the  PropertyGuru and iProperty verticals, in Vietnam through Batdongsan.com and in Thailand through DDproperty.com. In Indonesia, PropertyGuru operates the #2 vertical Rumah.com.

PropertyGuru and iProperty verticals, in Vietnam through Batdongsan.com and in Thailand through DDproperty.com. In Indonesia, PropertyGuru operates the #2 vertical Rumah.com.

The company's revenues increased in all of its operating markets apart from Vietnam where Batdongsan saw a 34% drop to S$3 million. The market has suffered greatly from government actions to tighten credit and the number of listings in the market dropped by 32% year-on-year.

As for profitability, PropertyGuru continues to do a good job of monetizing its native Singapore market and saw Adjusted EBITDA increase 23% year-on-year. The company has managed to increase its average revenue per agent in Singapore on a consistent basis since going public last year and the latest quarter was no exception with the average agent paying S$1,124, up 19% year-on-year.

Although PropertyGuru has stubbornly remained a loss-making business since floating on the NYSE, and has seen its share price plummet nearly 50%, CFO Joe Dische was upbeat about the company's recent performance:

"PropertyGuru delivered strong 35% revenue growth in 2022, with all our segments performing well despite challenging operating conditions. We are pleased with how well our business responded, with proactive cost control actions contributing to a S$25 million year over year improvement in Adjusted EBITDA. Our actions in 2022 have laid the foundation for further revenue growth and improvements in operating performance. We continue to scale the business, accelerate the realization of our investments, and leverage the deployment of further growth capital.”

In its Q1 press release, PropertyGuru reaffirmed its revenue outlook of S$160-170 million and Adjusted EBITDA of S$11-15 million for the year (2022's figures were S$136 million and S$14.5 million respectively).