The Japanese real estate portal operator Lifull yesterday announced its results for the 21/22 Japanese financial year.

The group which operates the Homes.co.jp portal domestically as well as international aggregators Mitula, Trovit and Nestoria (collectively known as Lifull Connect) generated Net profit despite a slight drop in revenue after a loss in the previous year.

The headline figures from Lifull's announcement for the nine months were:

The favourable comparable in Lifull's bottom line income was largely due to an impairment loss incurred in the 20/21 financial year related to the 2019 purchase of Mitula Group dragged the bottom line into the red.

Domestic portal operations saw lower revenue which was attributed to the discontinuation of Home's alliance partnerships and lower advertising prices for new-build properties due to rising real estate prices. The significant drop in profits (-85%) was chalked up by the company to a combination of decreased revenue as well as the impact of continued investment.

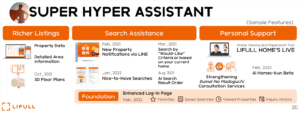

Taking a PR line similar to that of Zillow's much-touted 'super housing app', Lifull has been investing in its domestic operations to do away with poor quality leads and pivot domestic operations towards a 'hyper super assistant app'.

The positives for the operator of Japan's third most trafficked portal were that the number of listings was up 20% year-on-year and the number of client agents was also up by 2.5%.

Like its domestic segment, Lifull's Overseas segment saw profits slide (-63%). The company cited acquisitions, including the purchase of Latin American portal group Properati in January, and the transfer of personnel costs during the previous financial year.

Although Lifull's aggregator services and portals have in general been able to charge more for premium packages, the segment's reliance on the ever-decreasing payout from third-party ad services such as Google AdSense has impacted performance over the last few quarters.