The Mexican real estate portal industry has seen some big changes over the last few days.

Lifull made the purchase through RESEM, a subsidiary of its overseas division (known as Lifull Connect). Madrid-based RESEM already operates a number of minor portals in developing markets around the world including iCasas in Mexico.

Lifull Connect CEO Mauricio Silber said in a press release that by "combining the strong client network, property listings and brand recognition of Lamudi with Resem and other assets of Lifull Connect" the company will be able to accelerate growth in the country.

Meanwhile, the country's leading portal operator, Navent Group (which is owned by Brazilian unicorn Quinto Andar) has announced that it is shuttering Segundamano due to a "lack of relevance".

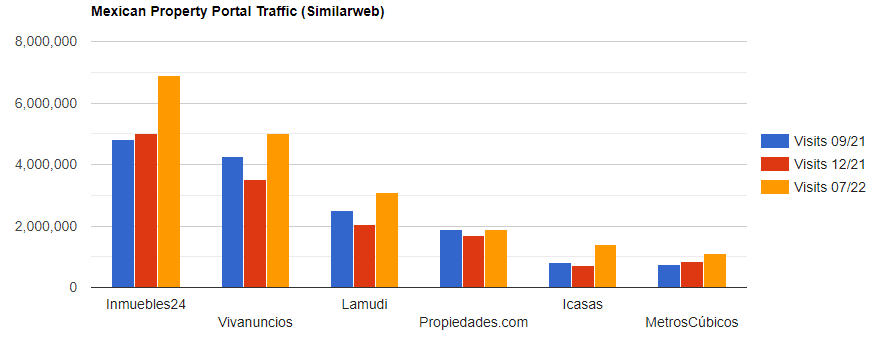

In an honest email to the site's users, the company admitted that the once-popular classifieds platform had seen 31% fewer visits and a 41% drop in lead volume. The company said that Segundamano was more and more difficult to run profitably and believes that its vertical sites (Inmuebles24 and Vivanuncios in real estate) are better positioned to serve users.

"Being a horizontal platform, there are other specialised solutions that generate greater value and a better user experience in each of their verticals."

Lamudi has been the number three portal in Mexico for some time. The portal was bought by EMPG in 2020 and a year later was handed $60 million and told to become the market leader within three years.

However, once Quinto Andar made a deal to buy #2 portal player Vivanuncios from Adevinta and unify it with Inmuebles24 in September 2022, Lamudi's hopes of overhauling its rivals were dead in the water.

Trauma followed as Lamudi CEO Jaume Molet said that the deal was "very bad news for the competitiveness of the real estate industry in Mexico" and the company made as many as 100 employees redundant within a month.

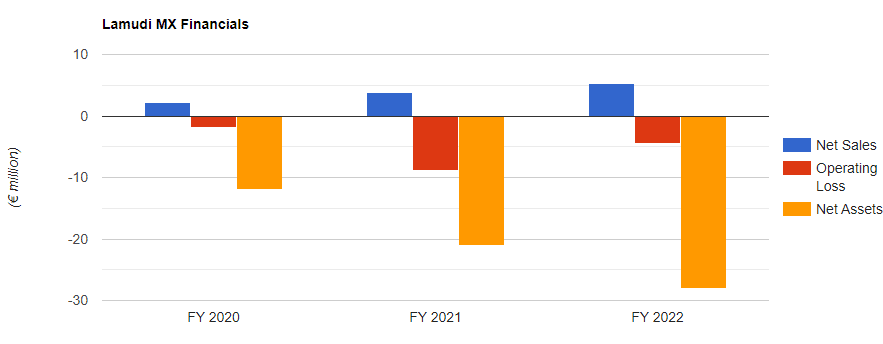

As for Lamudi's parent company, EMPG has been looking to trim unprofitable assets before an IPO "in the near future". The Dubai-based online marketplace operator has already sold off Bangladeshi portal leader Bproperty and is rumoured to have done the same with Kaidee, the Thai general classifieds site it bought in 2020.

A sale was inevitable and Lifull probably picked up Lamudi Mexico for a song.

Although the price paid was not disclosed, publicly-traded Lifull did release Lamudi's net sales and operating profit numbers in a statement to its investors. It would be fair to say that the Mexican portal has struggled financially for some time.

Lifull's interest in Mexico is understandable. Lifull Connect's aggregator sites (Mitula, Trovit, Nuroa and Nestoria) have historically been strong in Mexico and the country is an increasingly attractive market for proptech companies in general.

Like many so-called 'developing markets' around the world, the Mexican real estate industry is seeing the positive tailwinds of urbanization and an increasing agent commission pool. It's also a market with big problems that VC-backed companies believe they can fix with technology.

Fellow Brazilian PropTech unicorn Loft operates in Mexico through its TrueHome brand and Colombian marketplaces Aptuno and La Haus expanded north soon after their respective foundations.

Aside from its traditional portal businesses (Inmuebles24 and Vivanuncios) Quinto Andar recently launched Benvi, a platform that will operate the same commission-earning model as its wildly successful Brazilian flagship brokerage.

For EMPG

For Navent / Quinto Andar

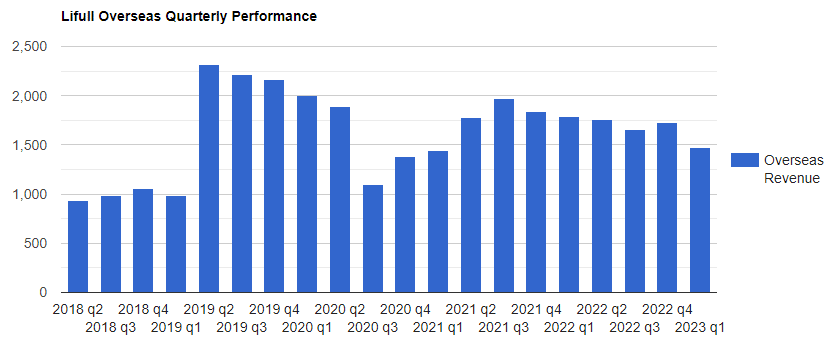

For Lifull Connect